At ManageMy, we solved a problem nearly every carrier faces: how do you deliver better digital experiences, faster — without replacing your core systems or getting stuck in IT queues?

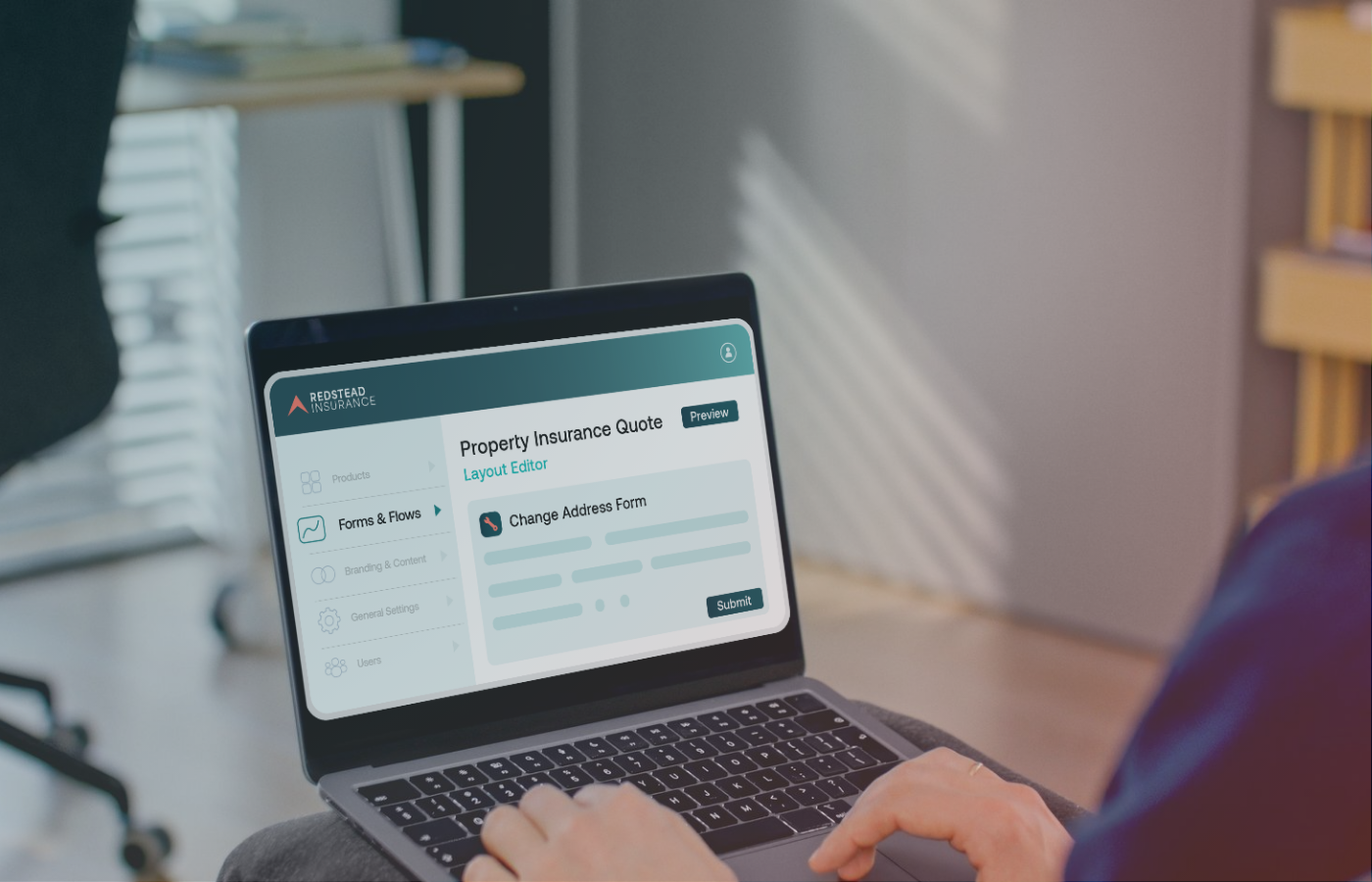

The answer is XPerience Studio, the no-code engine behind the ManageMy platform. It powers every digital journey, worfklow, and portal, and puts carriers in control of how they evolve them. With it, you can configure workflows, launch new products, connect to third-party systems, and update experiences, all without developers or major overhauls.

Whether you’re a Life carrier, a P&C carrier, or a fraternal organization, XPerience Studio helps you move faster and adapt more easily without compromising on integration or user experience.

The heart of XPerience Studio centers on three core functions: Products, Forms & Flows, and Branding & Content. Here’s how each one works, and helps carriers speed up delivery, reduce complexity, and improve the customer and agent experience.

Products: Configure and Control Your Insurance Offerings

Products is the place where carriers define their insurance products and connect them to operational workflows: quoting, policies, amendments, claims, renewals, and payments. They can also launch new products or updates fast, with a few clicks.

A Life or P&C carrier might use Products to:

- Create and launch new Term Life product from the ground up, with tailored quote and application workflows.

- Easily configure availability rules so an Auto product only appears in certain states or to certain customer segments.

- Auto-populate data into your customer journeys to reduce friction for customers and users (e.g., default coverage by age value).

- Manage API connections to a policy administration system (PAS) for issuing policies or processing renewals.

- Support different agency or brand structures, offering different products under different branding, without needing separate platforms.

Our goal is simple: let carriers manage their products without needing developer changes or vendor intervention. Everything from default values, availability rules, and field settings, to integrations with external systems can be configured in one place.

Every product is modular. Carriers can turn on or off the stages they need. If you only want quoting and policy issuance, you can skip claims, renewals, and amendments entirely. Flexibility is baked in by design.

Forms & Flows: Create Workflows Without Code

Forms & Flows is the engine behind the user journeys. Whether it’s a customer buying a policy online, an agent submitting a claim, or an internal CSR processing a service request, these workflows are designed, configured, and executed inside the platform.

Carriers can leverage Forms & Flows to:

- Build forms through drag-and-drop tools without needing developers.

- Set data validation rules, conditional visibility, and dynamic defaults.

- Create multi-stage workflows with branching logic, event triggers, and API-driven conditions.

- Connect forms to external APIs — pulling or pushing data at any stage of the workflow.

- Dynamically add or modify database fields without needing a developer.

With Forms & Flows, non-technical users have the power to create sophisticated experiences. If you want to trigger a different path based on a customer's age, automatically route a claim based on state, or send a personalized email after a policy change, you can do all of that without writing a line of code.

A Life carrier might use Forms & Flows to create a dynamic quote form that adjusts questions based on customer demographics. A P&C carrier might design a claims workflow that pulls VIN information from a third-party data provider mid-journey.

In any case, everything is API-ready, and everything can evolve over time without you ripping and replacing core systems.

Branding & Content: Own the Customer Experience

Branding & Content is where carriers create, launch, and customize the user-facing parts of their insurance experiences, from customer portals to agent workspaces to mobile applications. It acts like a lightweight CMS inside the platform, allowing carriers to manage not just the look and feel, but also the structure and static content of their digital properties.

Carriers can use Branding & Content to:

- White label their portals and digital experiences.

- Customize colors, typography, buttons, icons, and page layouts.

- Define navigation structures (menus, footers, pre- and post-login flows).

- Create agency-specific branding — where different agencies or brands under the same umbrella can have distinct look and feel.

- Manage static content pages, document templates, events, email templates, and in-app messaging.

Our goal was to make sure carriers weren’t locked into a generic look or rigid user-experience. If you want a portal for your agents that looks and feels different from your customer portal, you can do that. If you want a different navigation structure depending on user role or brand, you can configure that too through XPerience Studio.

Whether you’re a fraternal carrier hosting member events or a P&C carrier managing policyholders across multiple brands, you can tailor your digital experiences without rebuilding the platform or waiting on IT.

A Purpose-Built Solution

From day one, we designed ManageMy to be configuration first. Our belief was simple: if you can configure workflows, integrations, and branding without code, you can move faster, adapt easier, and serve your customers better — without the risks and costs of traditional development cycles.

XPerience Studio is a powerful tool, and the backbone, that lets our carriers own their digital journeys, respond to changing needs, and innovate without disruption. Everything, whether it’s launching a new insurance product, automating a claims workflow, or updating a portal’s look and feel, runs through XPerience Studio.

And that's exactly the point.