Empower Your Core

with the Deep Front-End for Insurance Carriers

The Difference is Experience

ManageMy provides carriers & brokers with best-in-class technology & services that drive business growth, streamline workflows, and reduce operational costs.

-

Expertly designed by insurance professionals for insurance professionals

-

Purpose-built for today’s insurance industry, including regulatory needs and cybersecurity

-

User-centric to make work faster & easier

-

Seamless, no-code API & Ai integration modes

XPerience the Difference

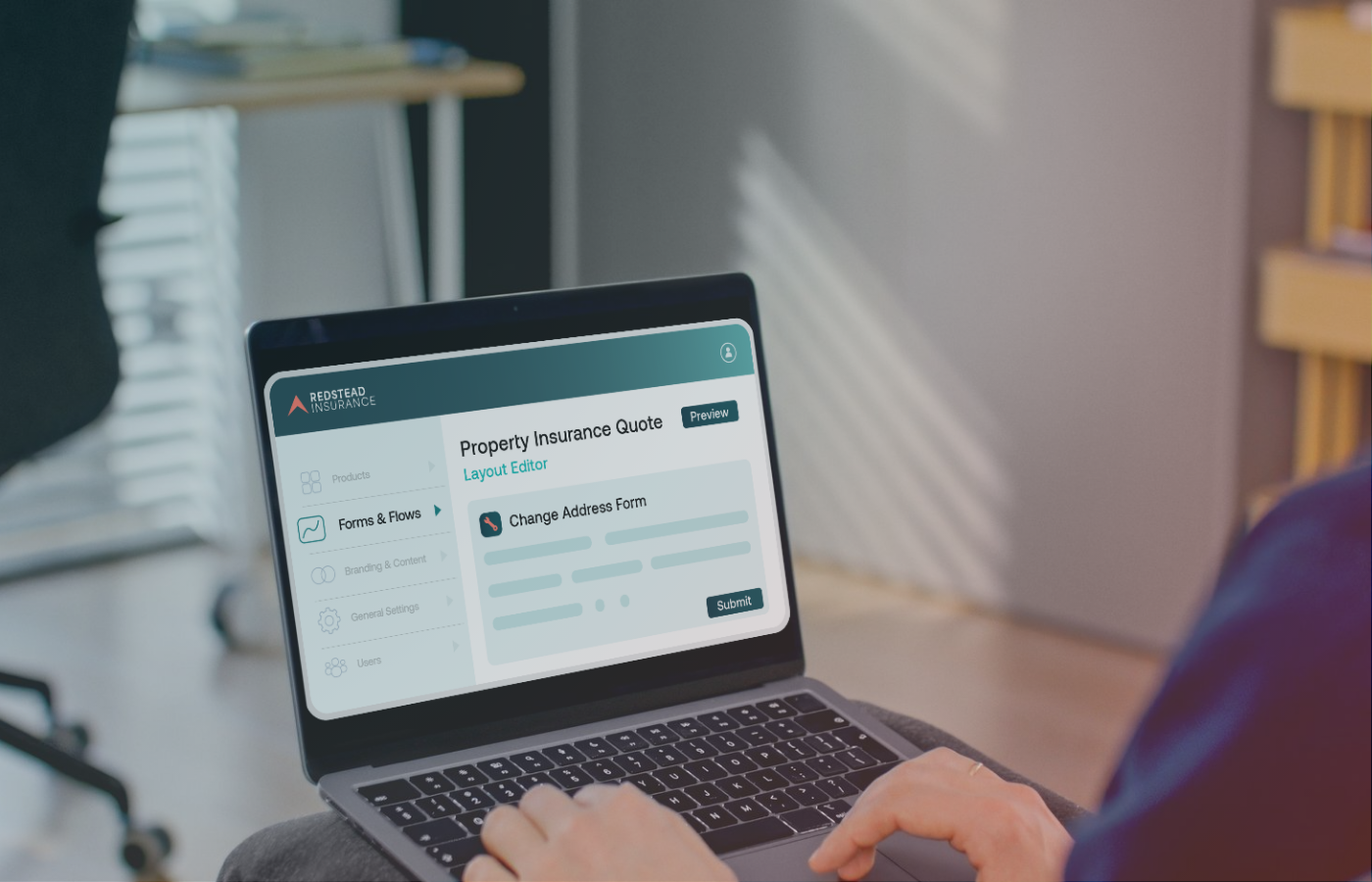

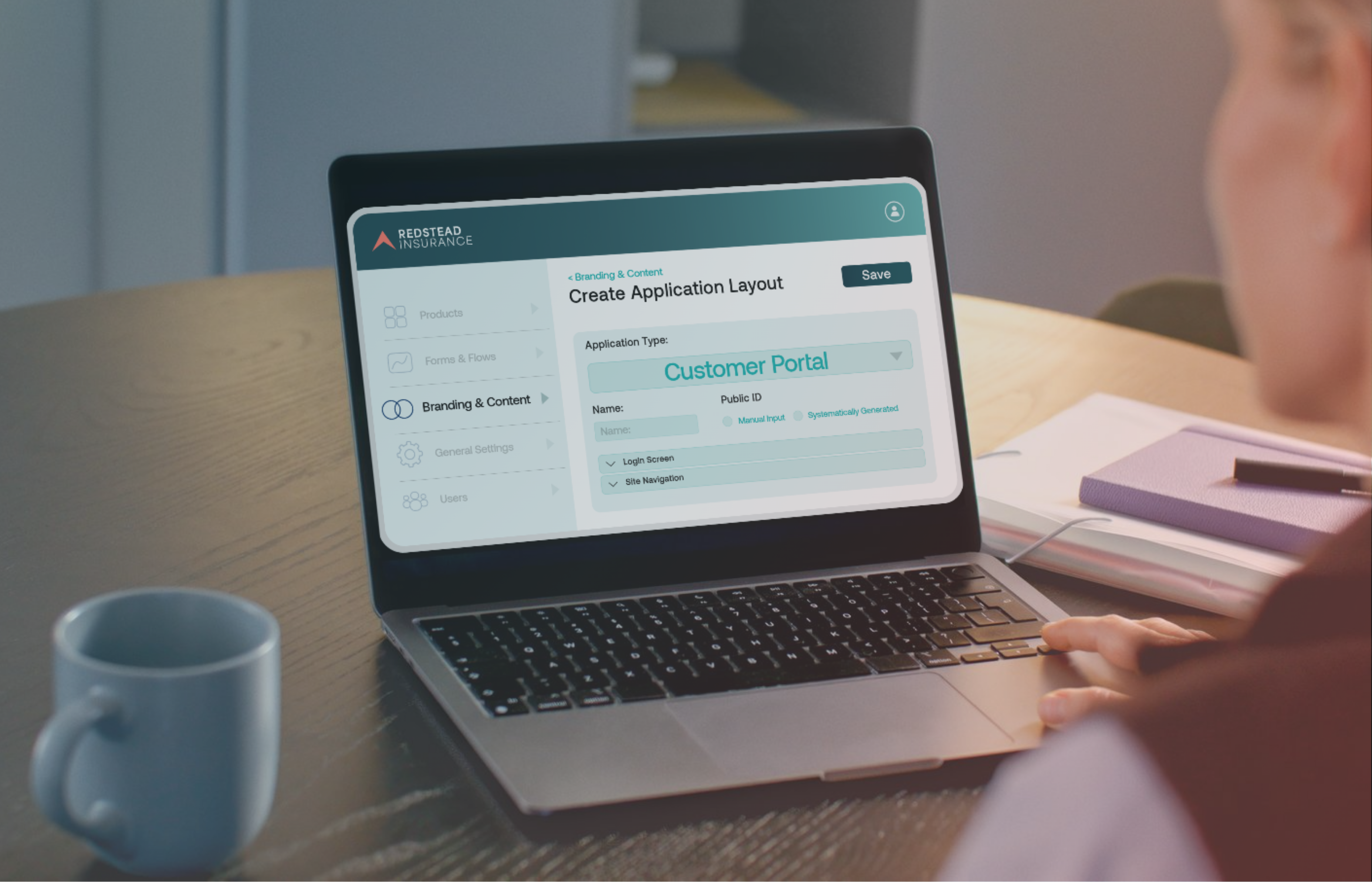

Simplify insurance with straightforward & easy digital experiences for carriers, customers, and agents.

| Vertical SaaS Model | |

| Advanced Intelligence & Agility | |

| XPerience Studio | |

| Enhanced Customer & Agent Experience |

Integrated marketing services optimize carriers’ portfolios & enhance profitability with data-driven campaign journeys.

| Advanced Analytics | |

| Strategic Communications | |

| Capitalize on Revenue Opportunities | |

| Invested Partnership |

Your Data, Our Priority

Trusted by Our Clients & Partners

We're thrilled to partner with ManageMy to enhance our document delivery processes and improve our overall customer experience. By leveraging their innovative platform, we're not only meeting the evolving needs of our policyholders but also driving significant cost savings for our organization."

With ManageMy, we launched a new customer portal with a mobile-first FNOL experience that’s easy to use and quick to configure. Our policyholders can now report a claim from any device. It’s streamlined, flexible, and has helped us strengthen digital engagement across the board."

Our goal was to improve the experience not only for our members and agents but also for our home office teams who serve them. ManageMy stood out for their partnership mindset and hands-on operational support. They’ve helped us streamline operations and increase membership satisfaction.”

-png.png?width=289&height=61&name=Untitled%20design%20(2)-png.png)

-png-1.png?width=289&height=61&name=Untitled%20design%20(4)-png-1.png)