Digitizing Onboarding in an Offline World

The Challenge

Our client is a global, multi-line carrier on the East Coast of the United States. ManageMy was engaged to deliver a Customer Engagement Platform for their auto insurance business. In conjunction with a large vehicle OEM, they had developed an innovative auto insurance product to offer customers at point of lease. Realizing that they needed a digital experience to meet the innovative nature of their product, harnessing both back end APIs, to enable real-time, automated insurance and a customer front end to meet the expectation of a more tech-savvy customer cohort, our client couldn’t find an internal solution.

So, they turned to ManageMy.

How it Works

Delayed Application Cycles

Our client needed to support their strategic partnership proposition. To differentiate their offering, and leverage a somewhat captive market, speed of transaction, automated document creation and retrieval, and a mobile app-based customer interaction were the key elements of our brief. Current processes meant customers faced significant delay before being able to drive off the lot with their new vehicle.

Customer - Agent Gap

The customers wasn’t the only end user to consider. Our solution needed to engage the car dealerships and give them a streamlined onboarding experience to drive uptake. ManageMy had to ensure the insurance experience enhanced the dealer interaction with the customer.

Absence of Self-Service

The platform needed post-sale features to support the customer in booking regular maintenance or accessing the OEM’s vehicle repair network. This had to sit alongside PAS integration to deliver real-time policy and customer data.

The Solution

Our client was looking for potential solutions to enhance their chances of partnering with vehicle OEM’s to offer insurance at point of sale/lease. ManageMy’s mobile app was a perfect fit for all of the customer facing requirements and delivered a number of additional features.

In less than 12 weeks, ManageMy’s solution was integrated to move data seamlessly from dealership to carrier to customer. By deploying ManageMy, our client’s customers received their policy documents in as little as 15 seconds.

Configuring ManageMy’s XPCustomer as a dealer portal gave our client a fantastic new digital solution which came as part of their insurance offering to their strategic partner.

How it Works

Customer App

The customer receives a personalized download link to complete insurance registration while dealer completes lease.

Data Capture

Customer data captured as part of lease are sent by API to the carrier PAS.

Real-Time Documents

The platform interacts seamlessly with the PAS to produce insurance documents and customer ID card.

Post-Sale Service

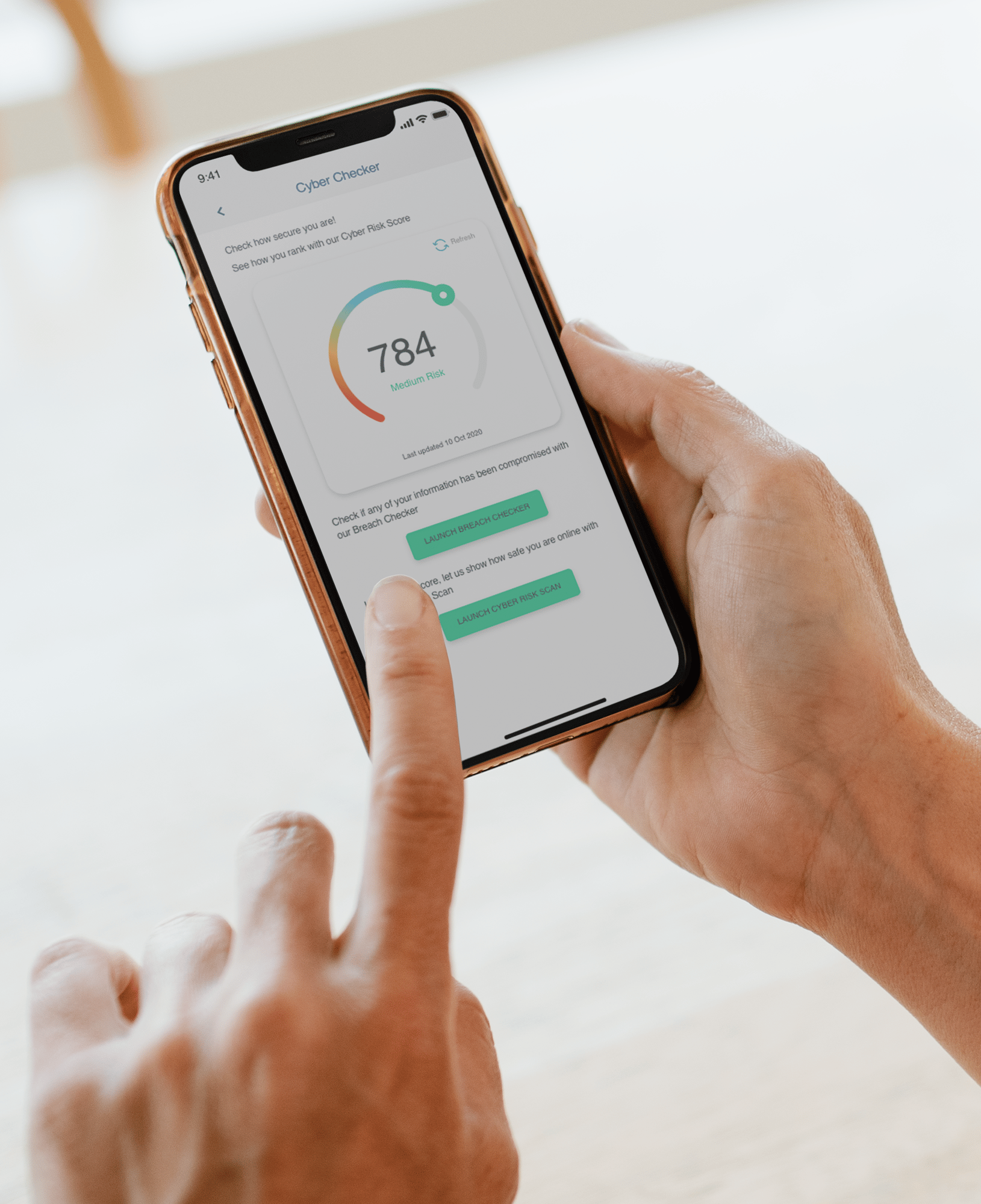

The customer uses the app to access documents, find repair shops and book regular maintenance.

Additional Information

Rapid Insurance

ManageMy’s mobile app and web portal were launched so customers would be covered and receive their ID cards in seconds, providing seamless policy issuance and peace of mind. Customer interaction at point-of-sale is now fully digitized – creating a lightning-fast experience.

Non-Core Customers

ManageMy’s integration with the OEM and carrier systems meant an excellent experience for dealerships as well. No re-keying and personalized customer communications meant a seamless and frictionless onboarding journey.

Major Benefits

The OEM’s customers now manage their auto insurance from the white-labeled carrier app – enabling real-time policy management, updates and communication. This carrier’s customers now have first class digital experiences when dealing with their insurance.

Reduced Costs

Cost reduction followed naturally. Our client was astounded at how quickly their customers embraced digital self-service, reducing phone calls and paper from day 1. This has freed up their administrative staff to handle more complex queries.

The Results

The dealership's time spent to onboard customer for insurance was immediately reduced by 95%, and subsequently reduced customer data capture time.

The speed of the technology, the ease of use and the attractiveness of proposition meant our client experienced a 57% reduction in their cost of acquisition from the very first day the ManageMy platform went live.

Stats

-

%

Improvement in Customer Data Capture time

-

%

Reduction in Customer Onboarding Time

-

%

Lower Cost of Acquisition

Added Benefits

Technical Expertise

Our client now utilizes a digital partner with years of experience in both insurance and technology to create and support their digital journeys.

Upsell Opportunities

Customers are now onboarding through an automated process thanks to ManageMy’s APIs. Call center staff are now freed up for higher value tasks.

Self-Serve

It’s now simple for dealers to capture customer details in one sitting and supply the customer with policy documents in real-time.

Ease of Use

Our client realizes opportunity to cross-sell to customer base – accessing revenue that was previously left on the table.