Streamlined Underwriting Experience

Enhance the quality of your underwriting and the new business experience.

Seamless Coverage, Smarter Underwriting

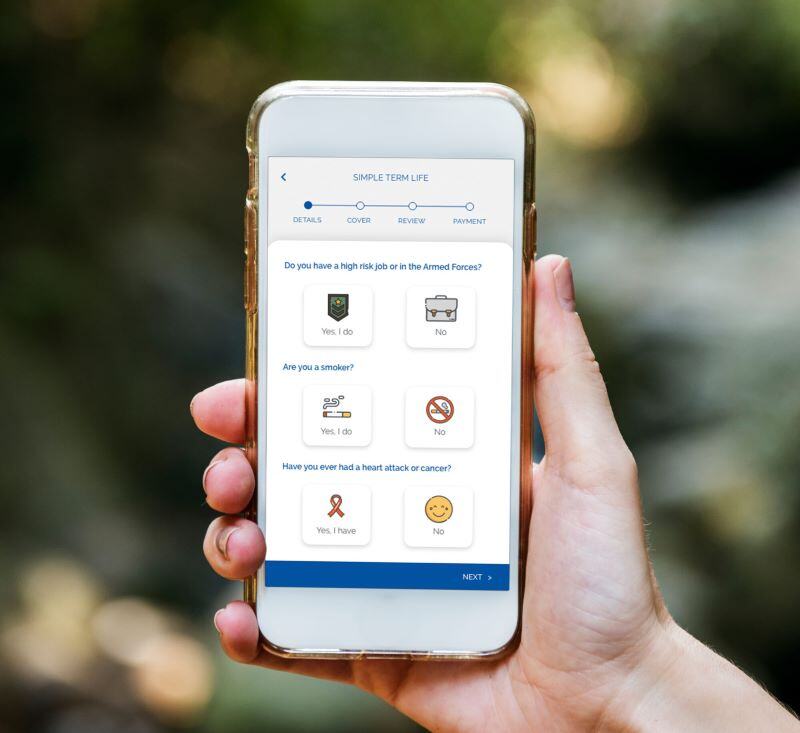

Guided, automated and responsive to customer needs, ![]() makes it easier for customers to get the coverage they need and for carriers and agents to write more coverage, more quickly, with less risk.

makes it easier for customers to get the coverage they need and for carriers and agents to write more coverage, more quickly, with less risk.

Key Features

Highly intuitive and responsive end-to-end agent and customer journeys from application to issue

Seamlessly power multi-brand, multi-channel, multi-product with a single unified engine

Flexible integration tools for a variety of implementation patterns enabling rapid speed

to market

AI-enabled decision making and customizable rules sets

How it Works

The Impact of

-

Improved Experience for Customers and Agents

Improved Experience for Customers and Agents- Guided, personalized journeys reduce application stresses

- Automation reduces form filling and question fatigue

-

Simply Better Underwriting

Simply Better Underwriting- Enhanced risk assessment and pricing

- Use of AI/ML and predictive modeling data

-

Faster Underwriting and Issuance

Faster Underwriting and Issuance- Increased STP means faster service, faster on-risk

- Increase in instant approval and reduction in double handling

-

Operational and Cost Efficiencies

Operational and Cost Efficiencies- AI/ML frees up human resources for high value tasks

- Streamlined policy issuance

The Complete Underwriting Process

-

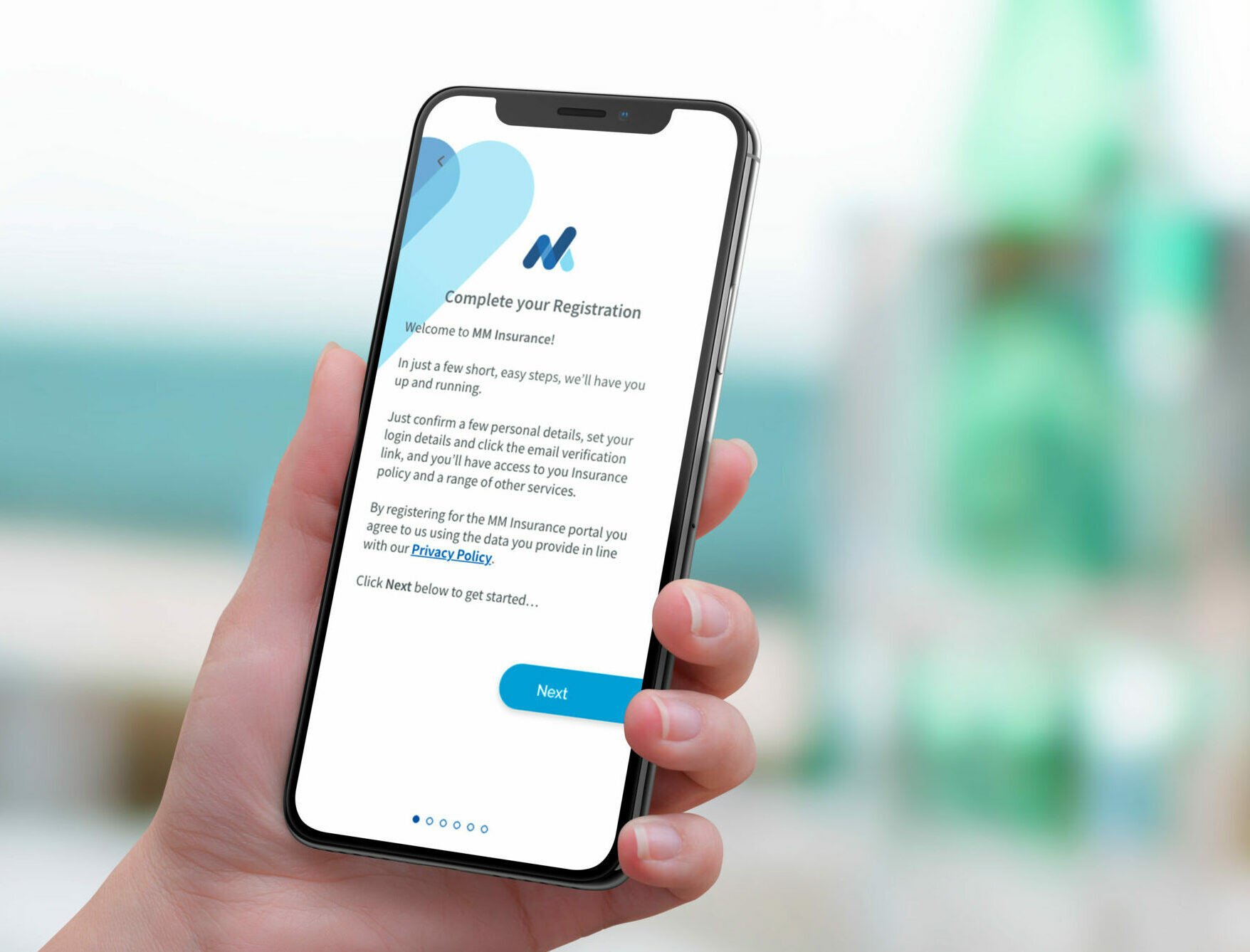

XP Customer

First-class UI for all users, providing seamless interactions at every touchpoint

- Centralized hub for core services

- Digital native, mobile-first, 24/7 access

- Easy-to-stand-up, no-code, purpose-built platform

- API-driven integrations to your key 3rd party service providers

- Smart digital workflow and document management

-

XP Claims

Fast, intelligent decisioning makes the claims process rigorous and responsive at the moment of truth for customers.

- A guided user interface promotes stress-free client navigation of the claims process

- Segmented, personalized customer journeys increase efficiency, reduce errors and simplify the claims experience

- Automated evidence gathering, triage and 360-degree claims assessment

- Supports multi-product, open/closed portfolios and multiple reinsurer books

guided, responsive UI and Concierge

Related Success Stories

-

P&C's 2024 Tech Evolution & Predictions for 2024

January 3, 2025 • by Janet Anderson -

Success Story

Success StoryDigitizing Onboarding in an Offline World

December 17, 2024 • by Janet Anderson -

Success Story

Success StoryCreating a New Purchase Journey for a Life Carrier

December 17, 2024 • by Janet Anderson -

Success Story

Success StoryCreating a Digital Journey for a Property Carrier

October 25, 2024 • by Janet Anderson